Important Information on Your Co-op’s 2020 BC Property Assessments

IMPORTANT: if you want to preserve your right to appeal your property assessment, the deadline is January 31. If there is any chance you will want to dispute your assessment, you should contact BC Assessment before the end of the month.

NOTE: AEC Property Tax Consultants is again offering CHF BC members a break (20%) on its normal recovery rate and it offers a complimentary review of your assessment. You still won’t pay for AEC’s services if an appeal is unsuccessful. (See below for more information about contacting assessment consultants.)

Property assessments concern co-ops. Seeing the value of your co-op’s property rise has a positive side — it can make borrowing easier if that’s something you need to do — but those increases may also have a cost impact. Property taxes are calculated by multiplying mill rates (municipally set) and the assessed values (determined through a provincial body).

The last few years have seen a couple of trends: overall, there have been increases in both property assessments and property taxes even though a number of co-ops have made appeals and there have been some changes in approach by the assessors.

Every year we try to get an overview of property values of non-profit housing co-ops. There are more than 260 co-ops of this kind in BC, but the number of properties is actually considerably larger. Some co-ops operate on multiple sites and may have several separate addresses for BC Assessment purposes, even if the co-op itself exists as a contiguous block. And some co-ops are partly or wholly stratified. For example, even though the First Avenue Athletes Village Housing Co-op has one building, it has 84 separate listings for assessment purposes*. We obtain information through management companies, directly from co-ops and from publicly available information from BC Assessment itself. We don’t get all the details, but we come close to capturing what’s going on in the sector.

We have much less information on property taxes. These are calculated from the assessed values, using differing rates for different municipalities. BC Assessment’s task is to determine value, not how much tax is to be charged on the properties. It has limited flexibility on how to classify properties.

What happened last year?

A dozen co-op properties saw reductions between their initial assessments and the final numbers. Most saw no change. The reductions arranged from 2.5% to 70%. A quarter of these co-ops saw very modest adjustments (<7%), half saw reductions of 10-25%, and a quarter saw reductions of 45% or more.

What’s the current situation?

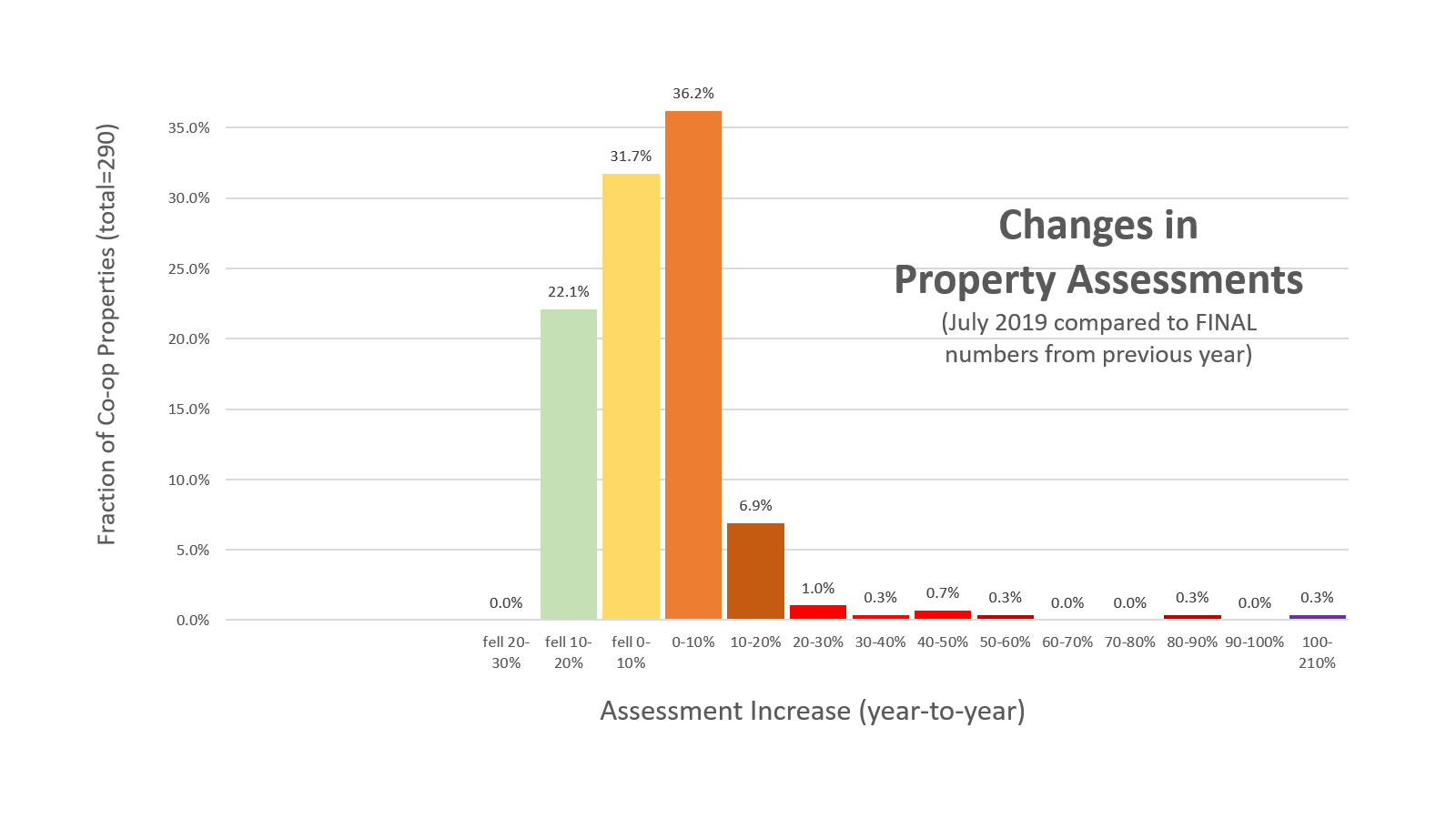

Take a look at the chart above which summarizes the changes for about 290 co-op properties. (The number reviewed is larger than the number of co-ops because some co-ops have multiple assessment addresses. Even so, a small number of co-ops are excluded from the counts.) The total combined value of co-op properties fell very slightly (<1%). A little over half of co-op properties saw no changes or modest reductions in their assessed values.

Co-ops should remember that increases in assessed value do not translate directly into property tax increases. Only if your property value increases more (or decreased less) than the average in your area will you see proportionally higher tax increases compared to other property owners. And homeowner grants may have an offsetting effect. Appealing an assessment is an option, but you’ll need to take quick action to secure your right to appeal: the deadline is January 31.

Arguing against your assessment

There are three common avenues to appeal your assessment (beyond notifying BC Assessment of simple clerical mistakes):

- Your buildings may be worth less than BC Assessment thinks, due to needed building repairs and renewals. This is usually the easiest argument to make. In the past, co-ops with envelope issues or other serious maintenance problems have been able to argue for reductions. Co-ops generally need supporting engineering documents (e.g. building condition assessments) to make this kind of overvaluation claim. Remember, if your co-op has seen significant capital works over the last couple of years, relative increases in your assessed value should be expected.

- Legal restrictions on the use of the land can also reduce assessments. Many non-profit societies with BC Housing agreements have covenants on title which serve to lower the assessed value. Do you have a covenant on title? Or a land use restriction? Or is your co-op property subject to zoning that may lower its value? Maybe an agreement with a municipality that does the same thing? Very few co-ops have covenants on title, but there may be avenues to explore in this area. AEC has been active on this front and has won a couple of appeal cases. CHF BC has been working with a legal team to better define options in this area as well. (Expect more information on this in the coming weeks.)

- Sometimes BC Assessment just gets it wrong. Comparisons with other similar, nearby properties are the best way forward in these cases, and that takes some research.

Resources

Property Tax Consultants

Co-ops will sometimes make appeals on their own, sometimes with the assistance of management companies, and sometimes they seek help from professional consultants. Although we are not making any recommendations, we know of a couple of firms that have worked with co-ops in the recent past: AEC (Vance Leschuk, direct tel: 604-629-4644, email: vleschuk@aecpropertytax.com) and Collingwood Appraisals Ltd. (tel: 604-526-5000).

There are others. Some firms will charge hourly rate fees for their services, others may seek compensation based on the size of the property tax reduction they are able to obtain for their clients (e.g. AEC). If your assessment has gone up significantly, you may want to appeal.

BC Assessment

The BC Assessment website has information you’ll find helpful. However your co-op decides to proceed, please remember the deadline for filing an appeal is January 31, 2020.

* When we discuss properties, we combine the stratified units into a single block. So when we talk of a sample of 290 properties, all those Athletes Village homes are considered as one property address.